arizona charitable tax credit list 2021

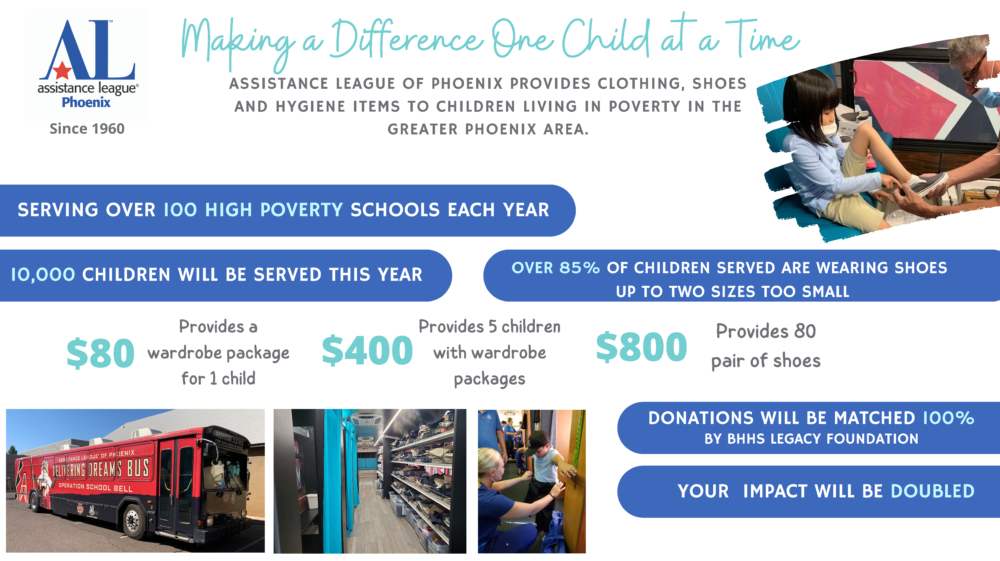

Qualified Charitable Organizations - AZ Tax Credit Funds. 5000 high quality books given to low.

2020 Arizona Tax Credit Limits And Links Sensible Money

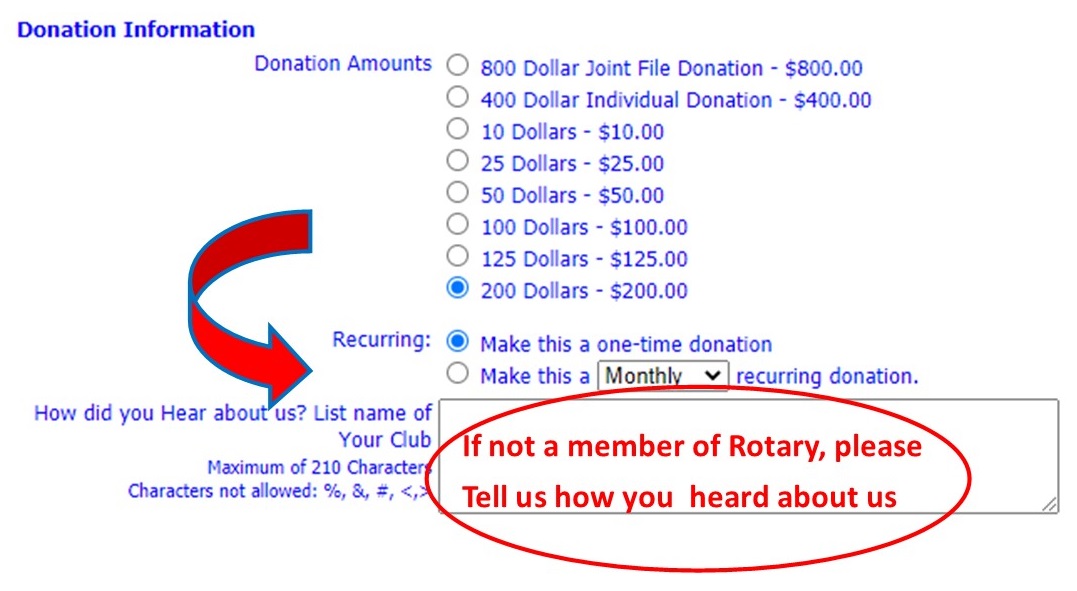

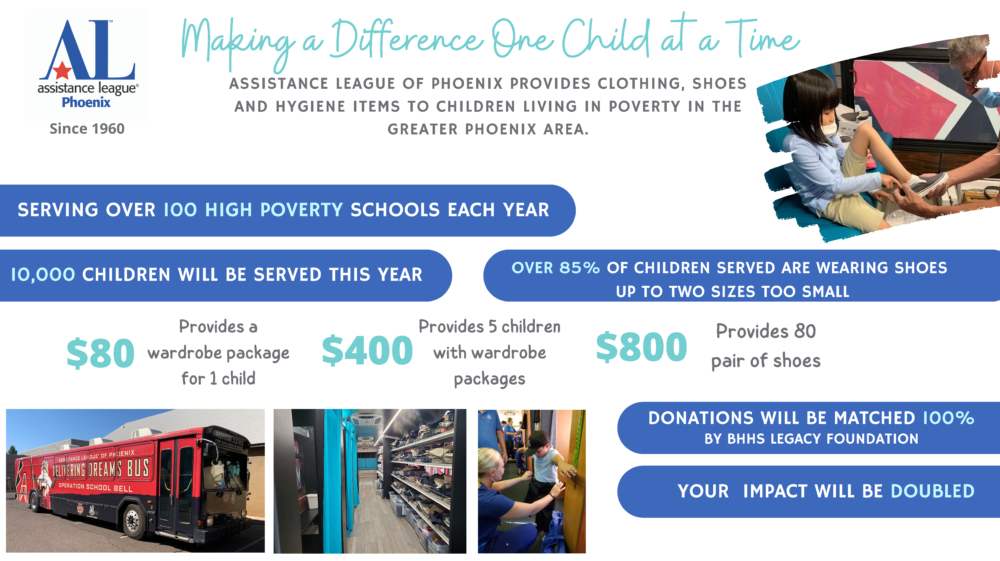

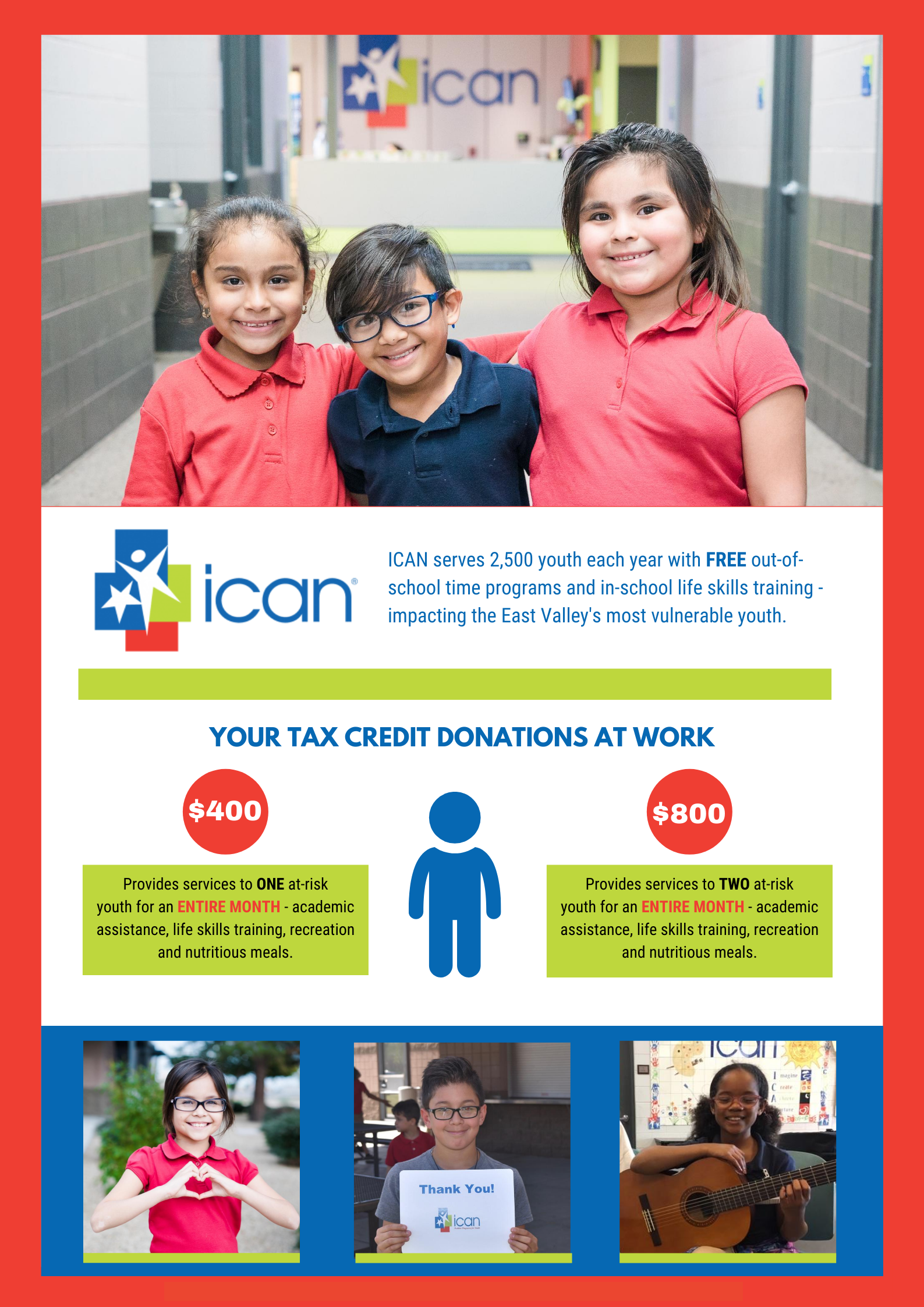

Make a Donation up to 800 with the Arizona Charitable Tax Credit.

. The credit for fees or donations to public schools made between January 1 2021 and April 15 2021 can be claimed either on your 2020 or 2021 Arizona tax return. The Arizona legislature has retained and expanded some of the incentives for charitable giving for. For the Arizona Foster Care Tax Credit that amount is 1000 for married couples filing jointly and 500 for individual taxpayers and married couples filing separately.

For example if you see a charity on the 2021 Arizona Department of Revenue list but you are making your donation in February 2022 you should check the 2022 AZDOR lists. There are four steps to document your donation and. When you want to take part in helping to make a difference feel.

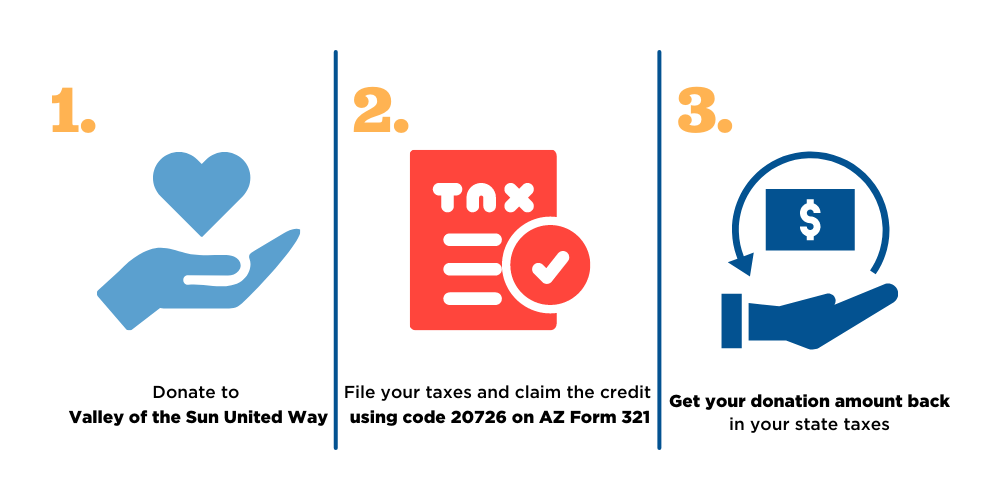

Control Alt Delete is a federally designated 501 c3 nonprofit and may be claimed as a deduction on federal taxes. The maximum allowable credit that can be claimed for single taxpayers married filing separately filers or heads of household filers for charitable contributions to QFCOs is 500 and 1000 for. July 15 2021 June 29 2022 Tax Department.

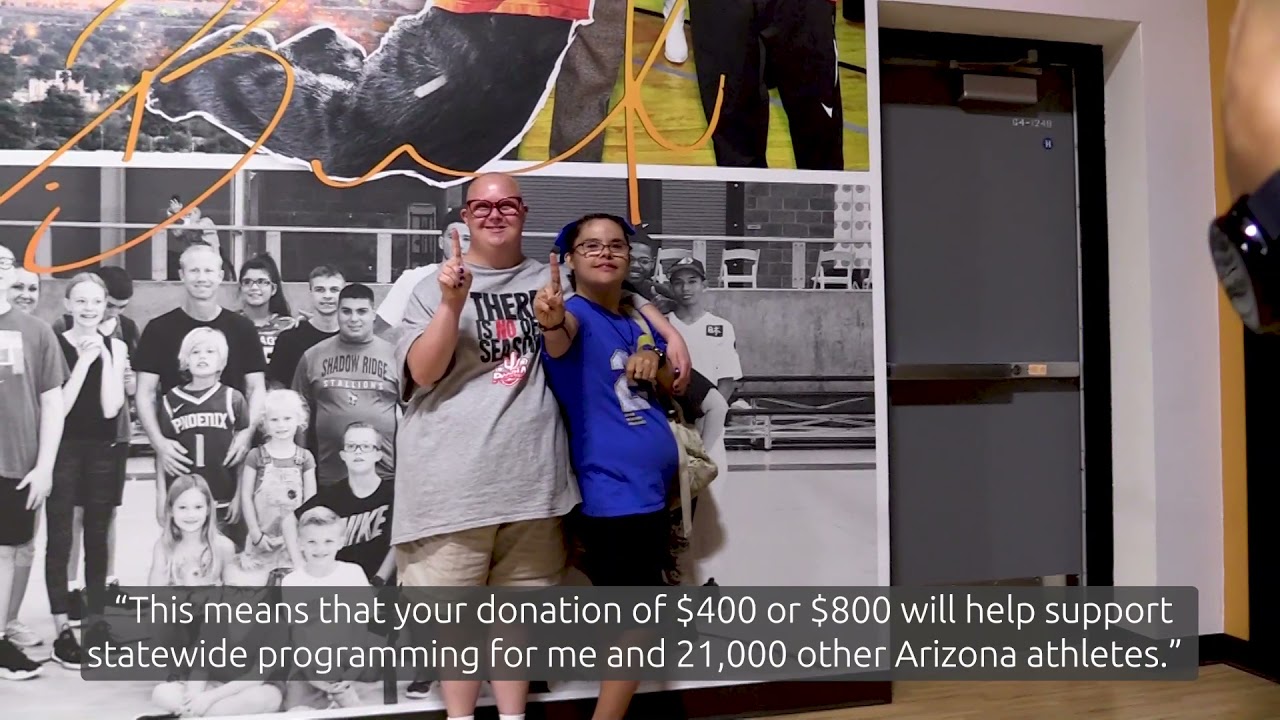

Arizona Charitable Tax Credit Claim AZ Tax Credit for 2021 by 418. Special Olympics Arizona partners with Executive. Donate up to 400 single filer and up to 800.

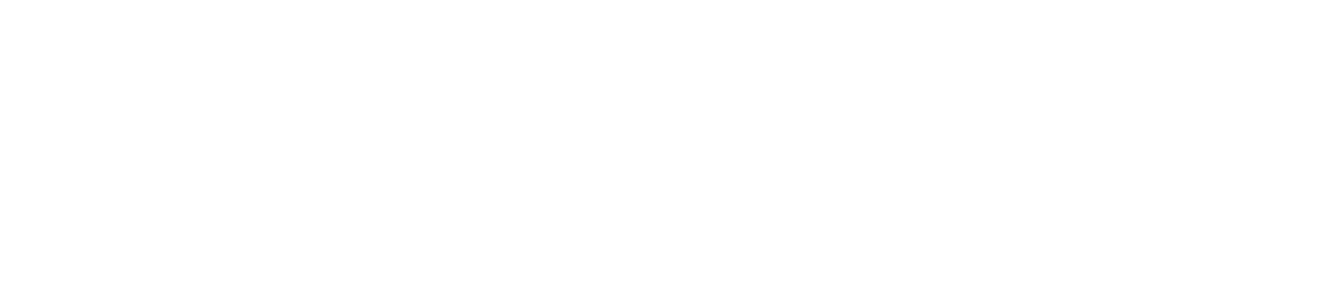

Here are some of the differences your contributions made. In 2019 over 4 million tax credit dollars were donated to GiveLocalKeepLocal charities. Fortunately the process for making a charitable contribution and claiming the Arizona Charitable Tax Credit is relatively straightforward.

Tax credits are more. As of today here is the list of QCOs-non-profit charitable organizations that are eligible for Arizona Tax Credit. The maximum credit allowed is 800 for married filing joint filers and 400 for single heads of household and married filing separate filers.

The amount you donate will determine whether you need to apply for one or both credits when you file your taxes. The maximum credit allowed is 800 for married filing joint. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit.

This tax credit is actually two separate credits. Arizona Tax Credit Alert 2021.

Az Tax Credit Gifts Youth On Their Own

Ways To Give Special Olympics Arizona

Foster Care Tax Credit Arizona Friends Of Foster Children Foundation

Valley Of The Sun United Way Valley Of The Sun United Way

Ways To Give Special Olympics Arizona

Qualified Charitable Organizations Az Tax Credit Funds

Arizona S Tax Credit For Qualifying Charitable Organizations Qco A Stepping Stone Foundation

Exploring The Potential Of Tax Credits For Funding Population Health National Academy Of Medicine

Tax Credit Child Crisis Arizona Qualifying Foster Care Organization

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Tucson Tax Credit Funds

Arizona Charitable Tax Credit List 2020

![]()

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S